As Hong Kong approaches almost six months of weekly street protests, its economy has slipped into recession. What does that mean for New Zealand economically, asks investment advisor Andrew Sayers.

Hong Kong has long been a significant investor in, and trading partner of, New Zealand. While New Zealand exports approximately NZ$1.7 billion of goods and services to Hong Kong annually, few people realise that Hong Kong is New Zealand’s second-largest source of foreign direct investment (FDI) - as at 31 March 2019 NZ$9.6 billion, an increase from NZ$1.1 billion in 2012.

During this period of just seven years, Hong Kong FDI surpassed Japan, the UK and the US. For these reasons, should New Zealand be concerned about the impact of the pro-democracy protests from an economic viewpoint, or does the current situation there represent an opportunity for the New Zealand economy?

I have been travelling to Hong Kong for business three to four times a year since 2005. During that time, I have noticed a significant increase in recognition from the Hong Kong business sector and high net worth individuals about the New Zealand market and what it has to offer. My business deals primarily with FDI, high net worth investment in private assets, and advisory services arising from these transactions.

I was last in Hong Kong in September. I witnessed first-hand the violent protests and sympathise with the Hong Kong community. The general sentiment of Hong Kong citizens is one of great uncertainty for their future, and in particular the ongoing status of Hong Kong’s functioning Special Administrative Region (SAR) of China

Economically, Hong Kong has enjoyed a wave of opportunity represented by the “one country - two systems” offered as a SAR, and the phenomenal growth of China’s economy, while being able to maintain a semi-democratic government, British rule of law and a good standard of living, in one of the freest economies in the world.

However, as a result of the protests, the Hong Kong economy is slowing, and entered a recessionary period starting in Quarter 3, 2019. Hong Kong’s real estate market has also cooled significantly. Clients are reporting they are struggling to sell residential property, even at a 20-25 per cent discount on the market value six months ago. Hong Kong’s key stock index, the Hang Seng, has also fallen 12 per cent during this six-month period.

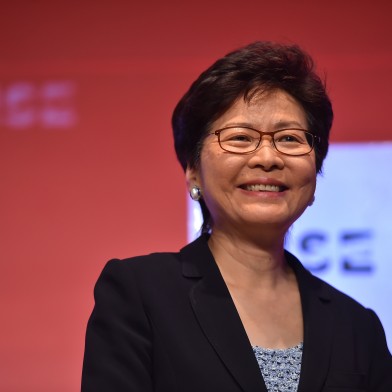

Hong Kong has been rocked by protests for more than five months.

The risk

Hong Kong has long been seen as a preferred gateway for Western business to access the mainland Chinese market, but in reality this has always been a short-sighted view. China is an enormous, largely undefined and complex market. Hong Kong, on the other hand, is also a large consumer market, and New Zealand’s increasing capability to export items in demand by Hong Kong has been well received. Hong Kong is also a great starting point to the broader Chinese market because 80 per cent of Hong Kong’s tourists come from China. In other words, exporting products or services to Hong Kong provides exposure to the greater China market.

The 2019 increasingly violent pro-democracy protests have been challenging Hong Kong for more than five months. These protests have significantly impacted Hong Kong’s tourism sector (tourist numbers were down 40 per cent in August compared to August 2018), and therefore retail and hospitality revenues are also down significantly. Because New Zealand’s largest exports to Hong Kong are in the food and beverage sector (diary, meat, produce and wine) I expect this reduction in tourist numbers to have a very real impact on New Zealand businesses exporting to Hong Kong in these, and other, sectors.

The opportunity

I am experiencing significantly increased interest from Hong Kong residents for New Zealand investment and migration opportunities. Naturally, this is not limited to New Zealand. There has also reportedly been increased enquiries from Hong Kong citizens in the UK, US, Australia and Canada. Hong Kong residents want a better living environment and education for their children.

While the recent changes under the current Labour government to effectively ban foreign ownership of existing residential property significantly cooled Hong Kong’s (and other jurisdictions’) appetite in New Zealand as a migration or investment market in 2018, the Hong Kong protests have reignited enquiries. Commonly requested investments include residential property development, agricultural (and agritech) assets, commercial property and hotels, food and beverage, nutraceuticals, etc. On the immigration front, I also understand Immigration New Zealand is fielding significantly more enquiries from Hong Kong nationals, and I know New Zealand’s Investor Visa ($3m and $10m category visa) application numbers are up from prior years.

So, what does all this mean? New Zealand has an existing, thriving and productive Hong Kong community. Some have been here for generations and others have recently migrated. In my experience, New Zealand resident Hong Kongers are outstanding members of the community, they integrate well, work hard, create new business opportunities and employment.

They have a passion and respect for New Zealand and what it has to offer. While it is sad to witness the recent events in Hong Kong, and it will represent a more challenging market to exporters, I believe it offers a great opportunity for New Zealand to attract additional Hong Kong sourced capital, which ultimately will further New Zealand’s economic growth.

Views expressed in the article are personal to the author.